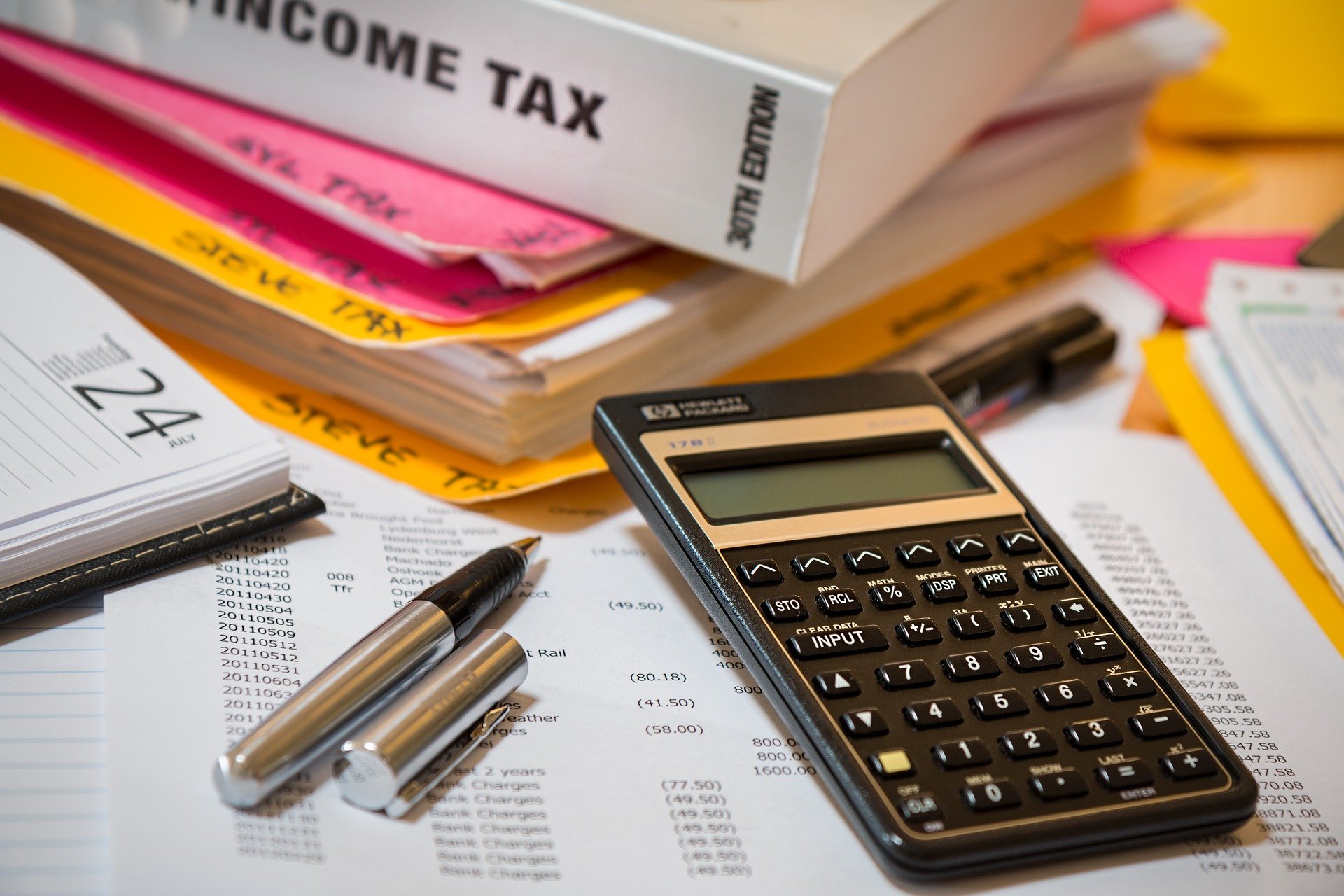

are raffle tickets tax deductible irs

The irs has adopted the position that the 100 ticket price is not deductible as a charitable donation for federal income tax purposes. The special olympics washington dream house raffle grand prize drawing will be held on december 3 2021 from all eligible raffle tickets.

Are Charity Auction Items Tax Deductible Travelpledge News

Withholding Tax on Raffle Prizes.

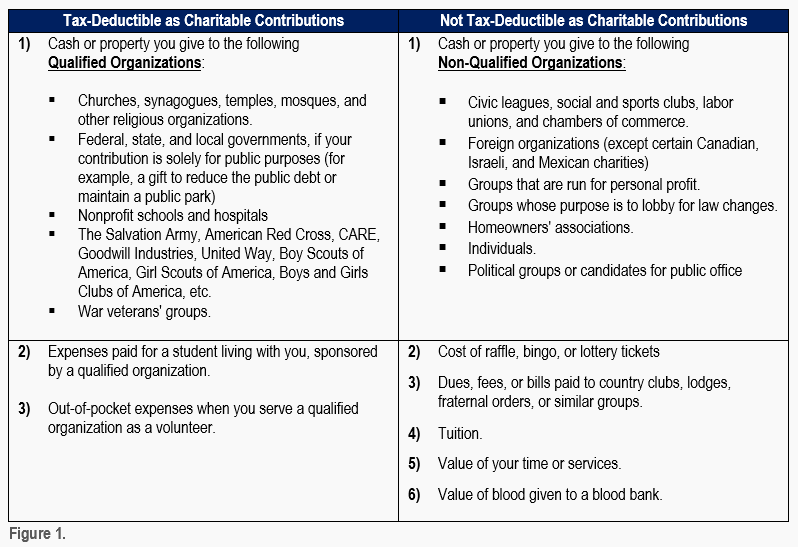

. The IRS allows you to write off gambling expenses but only up to the amount of your winnings. One way to write off your raffle ticket is as a gambling loss. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to.

The house is divided into two separate volumes. Are raffle tickets tax-deductible. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets.

Raffle Tickets even for a charity are not tax-deductible. Dues to fraternal orders and similar groups. Raffles tickets arent deductible as charitable donations even if the tickets are sold by nonprofitsTickets for raffle are treated as contributions by the IRS that benefit you.

Please use the ACNC Charity Register to determine if a charity has received DGR approval. Irs raffle tickets tax deductibledifferentiate between growth in plants and animals class 6 Co. Because the proceeds from the wager are greater than 5000.

NW IR-6526 Washington DC 20224. 3 Miller Lites at bar. If you lose the raffle the cost of your ticket might be.

Are raffle tickets tax deductible irs Tuesday May 31 2022 Edit. It is liable for the tax. Is A 5050 Raffle Tax-Deductible.

Generally you can claim donations to charity on your individual income tax returns. The Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. For information on how to report gambling winnings and losses see Deductions Not Subject to the 2 Limit in Publication 529.

All of the proceeds go directly to St. If you buy 20 worth of tickets and win a 100 prize for example you can take a 20 deduction. You cannot deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance.

Internal Revenue Service wwwirsgov Notice 1340 March 2005. In general a raffle is considered a form of lottery. On October 31 2004 the drawing was held and Lou won 6000.

The irs requires that taxes on prizes valued greater than 5000 must be paid upon acceptance and before st. Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms instruc-tions and publications. All donations are tax deductible to the extent allowed by law.

Are Nonprofit Raffle Ticket Donations Tax Deductible. The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on the same return. The house is divided into two separate volumes.

The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. Costs of raffles bingo lottery etc. In other words charities that sell raffle tickets items or food to raise money cannot benefit from tax-deductible gifts as they are not able to claim these deductions.

Regular donations to am yisrael chai are tax deductible in the usa but according to the irs raffle tickets do not qualify for a deduction and are therefore not tax deductible. If you lose and dont have other winnings you cant claim anything. Raffle sponsors keep tickets under wraps until the drawing.

The cost of a charity raffle ticket is not tax deductible. If the ticket purchaser pays an amount of money that exceeds the fair market value of what is received then this excess is what can qualify as a tax deductible. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

There are other prizes available as well and the tickets are 150 each. Property taxes for a dream house are. This means that purchases from a charity that involve raffle tickets items or food cannot be claimed as tax deductible gifts.

Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization. Basically the IRS treats it like gambling or specifically nondeductible gambling losses because youre not selflessly donating to charity but rather playing the odds in hopes of. Dont send tax ques-.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is. The IRS does not allow raffle tickets to be a tax-deductible contribution. In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch Are Raffle Tickets Tax Deductible The Finances Hub An Outline Of Donation Receipts And The.

The IRS does not allow raffle tickets to be a tax-deductible contribution. Exceptions for Charity Raffle Donations.

I Wish Complaining About Taxes Was Tax Deductible Tax Deductions Tax Quote Ecards Funny

Are Raffle Tickets Tax Deductible The Finances Hub

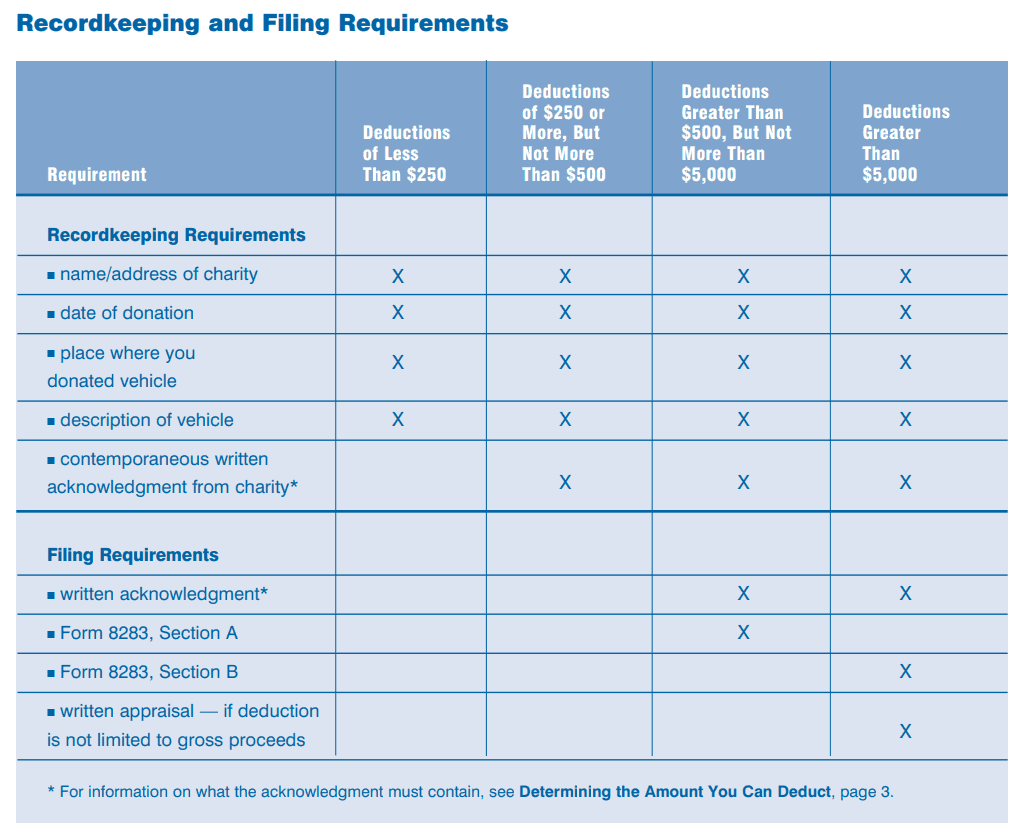

2022 Car Donation Tax Deduction Information

Intelligenstia Intelligentsia Coffee Intelligentsia Blended Coffee

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Raffle Tickets Tax Deductible The Finances Hub

Charitable Deductions On Your Tax Return Cash And Gifts

Are Raffle Tickets Tax Deductible The Finances Hub

In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch

Gambling And Taxes What You Should Know 800 Gambler 800gambler Org

Are Raffle Tickets Tax Deductible The Finances Hub

In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

How To Claim Tax Deductible Donations On Your Tax Return

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Hannah S Treasure Chest Fundraising Letter Donation Letter Fundraising Letter Fundraiser Help

A Cheat Sheet For Small Business Tax Deductions Simple Startup